What Is Islamic Capital Market

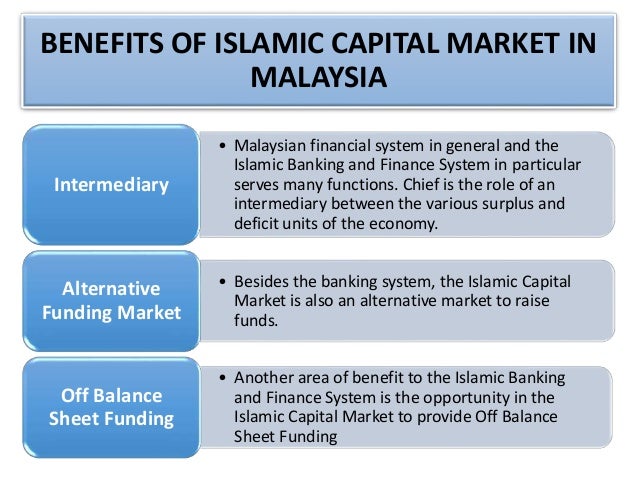

It enables the efficient mobilisation of resources and an optimal allocation thereof thereby complementing the financial intermediary role of islamic institutions in the investment process see aziz 2012b.

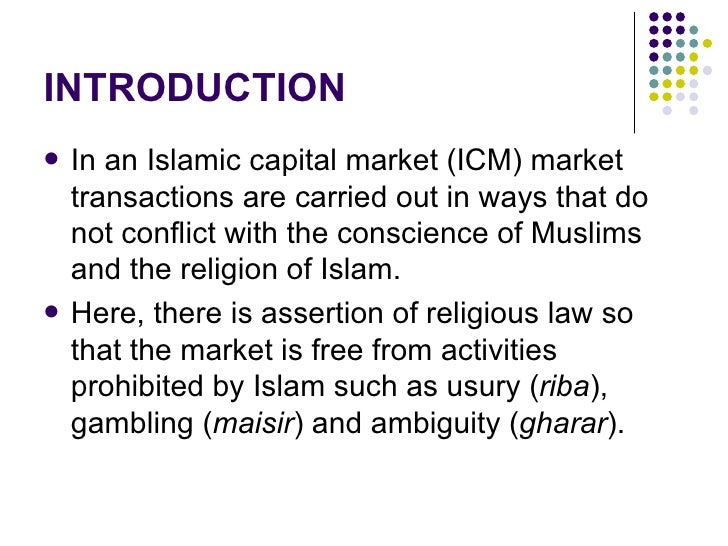

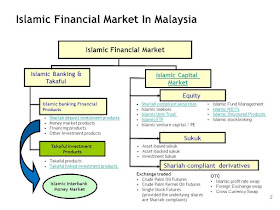

What is islamic capital market. Within realization of this course students will be familiarized with islamic capital markets in general as well as islamic capital market instruments. Components of the islamic capital market icm is one of the two important aspects of the broader islamic financial market the other branch constitutes islamic banking and islamic insurance better known as takaful. The islamic capital market is an integral part of the islamic financial system. A company may undertake an ipo.

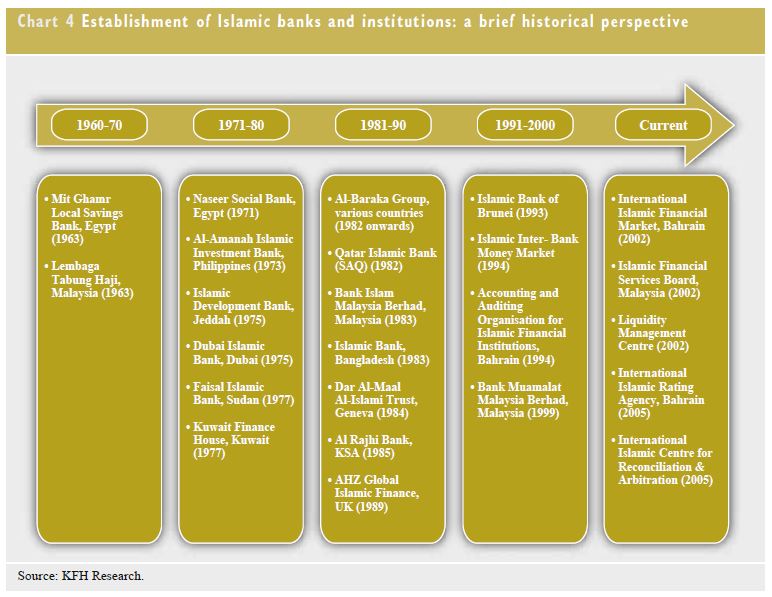

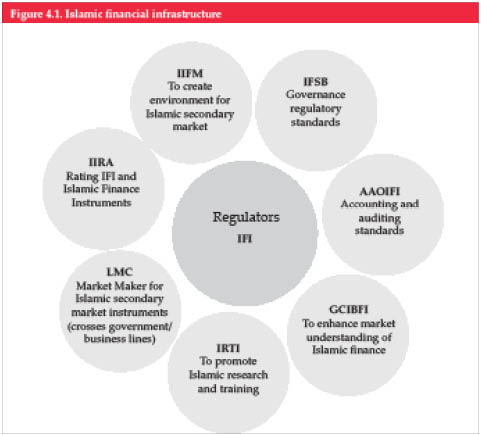

Where exactly is the islamic capital market located. The islamic capital market icm functions as a parallel market to the conventional capital market in malaysia. Islamic capital markets in recent years had huge development what put them to the focus of many economic academicians and capital market professionals islamic but also conventional ones. As such the capital market helps in capital formation and economic growth of the country.

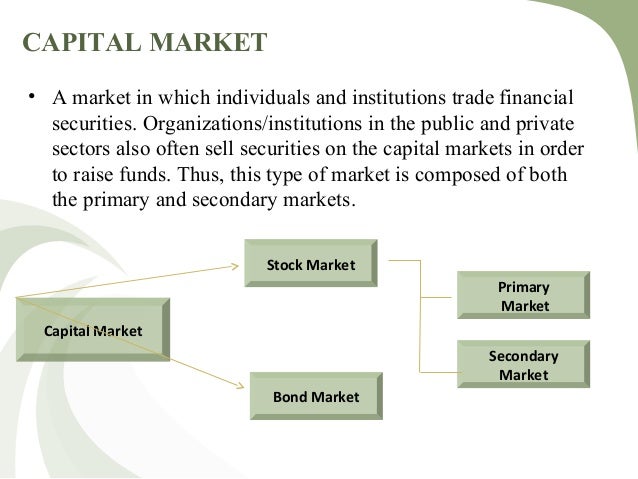

The icm functions as a parallel market to the conventional capital market and plays a complementary role to the islamic banking system in broadening and deepening the islamic financial markets in malaysia. In total islamic assets are worth an estimated 1 trillion at the time of this writing and about 25 percent of that amount is tied to the islamic capital market. The capital market acts as an important link. Capital markets are financial markets for the buying and selling of long term debt or equity backed securities.

What are the islamic capital markets. Islamic capital market islamic investment funds islamic capital market bursa malaysia slideshare uses cookies to improve functionality and performance and to provide you with relevant advertising. If you continue browsing the site you agree to the use of cookies on this website. It plays an important role in generating economic growth for the country.

Includes sharia acompliant stock and or sukuk markets. The primary role of the capital market is to raise long term funds for governments banks and corporations while providing a platform for the trading of securities. The market s current growth is between 12 and 15 percent annually. The icm is a component of the overall capital market in malaysia.

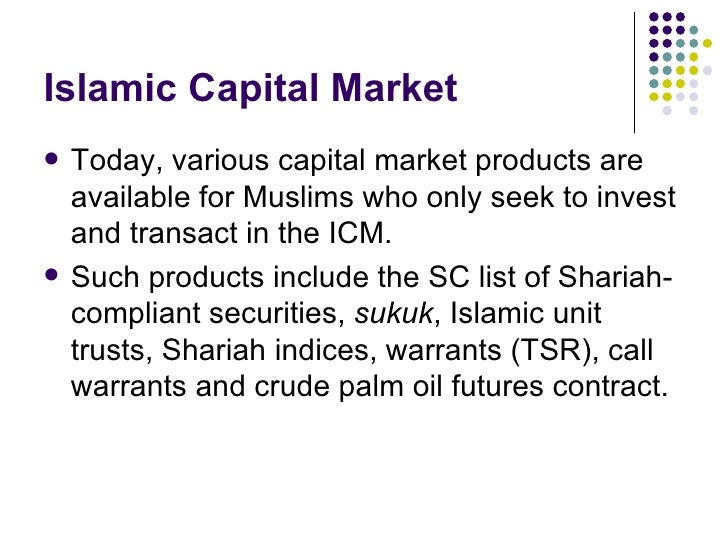

The capital market plays an important role immobilising saving and channel is in them into productive investments for the development of commerce and industry. Difference between money market vs capital market. Icm comprises of islamic equity islamic bond sukuk and islamic compliant derivatives. How to identify exchanges on the islamic capital market.

Companies and governments use the islamic capital markets to raise funds for their operations or expand ongoing activities e g.